Can Palm Vein Payments Scale Without Disrupting Existing POS Systems? *— An Industry Perspective from BioWavePass*

As biometric technology rapidly moves from pilot programs into real-world retail, one question keeps coming up across fintech, government, and cashier platform stakeholders:

Can palm vein authentication be scaled without interfering with the existing POS ecosystem?

At BioWavePass, we believe the answer must be yes — and here’s why this matters more than ever in today’s evolving payment landscape.

💼 The Complexity Behind Retail Payment Systems

Fintech companies and cashier platforms operate in complex environments. Many already serve tens of thousands of stores, where each store may use multiple POS terminals, often from different brands, models, and manufacturers. This fragmented landscape makes integration a key barrier to adoption for any new authentication or payment technology.

Add to that the concern of regulatory compliance, data privacy, and legacy software, and it’s clear that asking every retailer to reconfigure or upgrade their entire POS system for a new biometric solution is simply not scalable.

🤖 The Role of Palm Vein Technology in Seamless Authentication

Palm vein recognition — known for its high security, contactless interaction, and user convenience — is gaining traction as a future-proof authentication method. But to reach real commercial scale, it must:

- Integrate with minimal effort

- Work independently from legacy POS systems

- Support government-related payments and subsidies

- Maintain operational stability and speed at checkout

⚙️ How BioWavePass Solves These Industry Challenges

At BioWavePass, our team has been focused on a single goal:

Make palm vein payment adoption seamless — without requiring deep changes to existing cashier systems.

Here’s how we do it:

- ✅ Modular integration: Our system can work in parallel with existing POS devices, reducing dependency on POS software modification.

- ✅ Custom-fit development: For each fintech or cashier platform, we tailor the deployment process based on their real-world architecture.

- ✅ Low-friction deployment: We minimize unnecessary communication between palm vein authentication and the cashier/POS logic, helping speed up rollouts.

- ✅ Government subsidy compatibility: Especially for markets where subsidy-based grocery purchases are common, we ensure our solution does not disrupt critical flows.

🤝 A Culture of Doing More for Our Clients

Internally, we often ask ourselves:

Can we do more, so our clients can do less?

Our partners are under pressure from both technical and business sides. Their success depends on smooth deployments, user acceptance, and operational reliability. That’s why we design BioWavePass not just as a product — but as a solution backed by thoughtful support, flexible engineering, and long-term partnership.

🚀 What’s Next?

Palm vein technology is no longer a “future” concept — it’s a now solution. But to make it work at scale, vendors need to think beyond accuracy and security.

Interoperability, ease of deployment, and system neutrality are what will truly unlock mass adoption.

If you’re a fintech platform, government program, or cashier system provider exploring biometric payment options, we’d love to hear from you.

🔗 Let’s build the future of frictionless identity and payments — together.

| [📅 Book a Demo]

Share this article

About the Author

You might also like

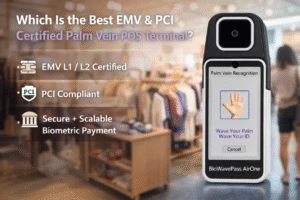

Which Is the Best EMV & PCI Certified Palm Vein POS Terminal?

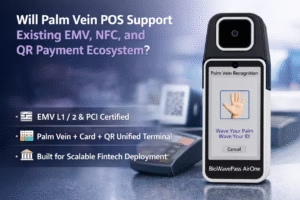

Will Palm Vein POS Support Existing EMV, NFC, and QR Payment Ecosystem?

Why Palm Vein Technology Is Emerging as a Payment-Grade Biometric Standard

Where Is Palm Vein Biometric Data Stored and How Is It Secured?

How Do You Choose the Best Palm Vein Technology for Real Projects?

How to Solve Power Issues in Palm Vein Scanner Projects?

What Is Palm Scanning Technology?

How Palm Vein Biometrics Can Be Integrated Into Mobile Payment Systems: A BioWavePass Implementation Guide

How to setup Palm Payment? Designing a Seamless Palm Payment Flow for Fintech and Payment Platforms