The Story Under Your Hand- Palm Vein Scanning

How BioWavePass Is Redefining Palm Vein Biometrics

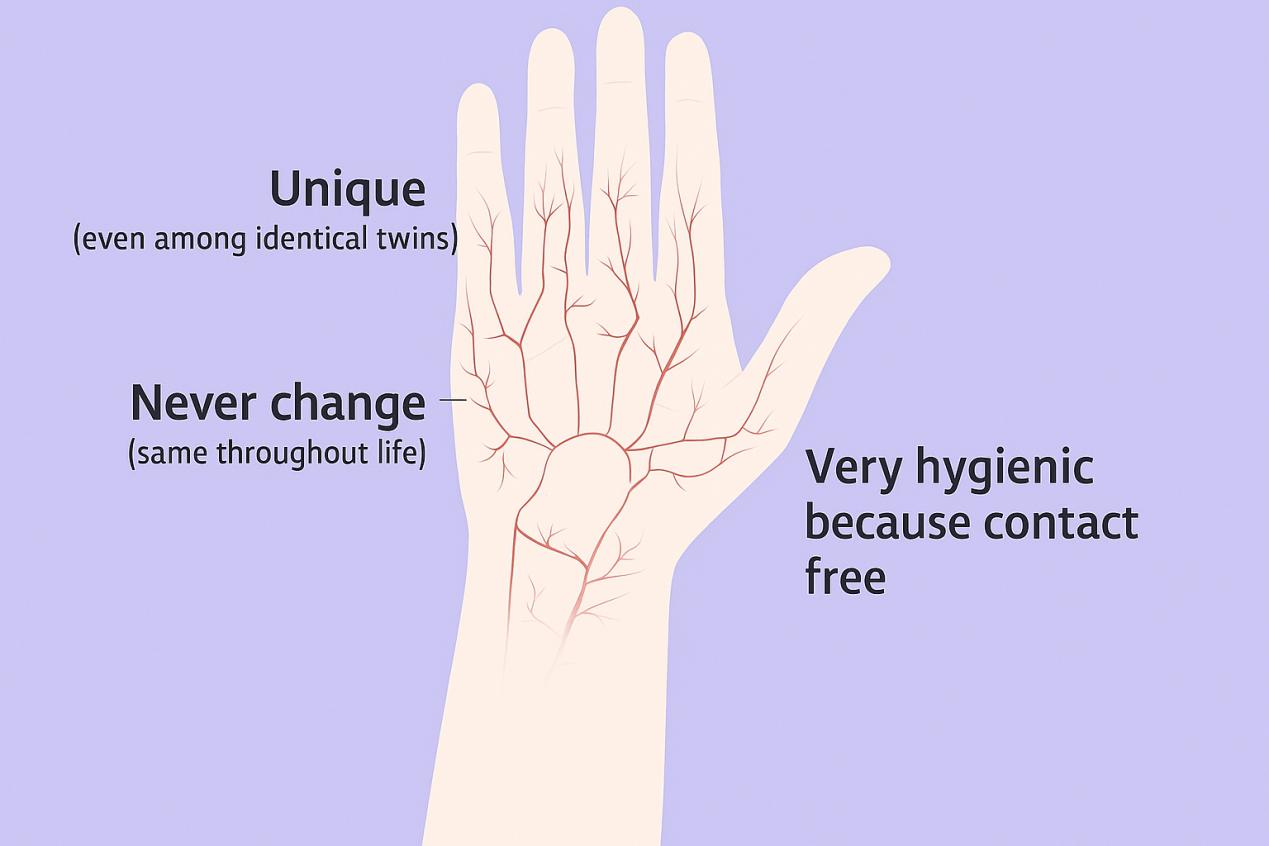

When you look at your palm, you might see familiar lines and folds — but hidden just beneath is a world that’s uniquely yours. A network of invisible palm veins, distinct in every human, even identical twins. This invisible identity is now becoming the foundation of a new generation of secure, contactless authentication — and BioWavePass is at the heart of it.

🔍 What is Palm Vein Scanning?

Palm vein biometrics is a revolutionary form of identification that uses near-infrared light to scan the internal vein patterns in your hand plus RGB Palm Vein image technology. Unlike fingerprints, which are visible and vulnerable to spoofing or wear, palm vein patterns are internal and invisible to the naked eye, making them highly secure and resistant to forgery.

En BioWavePass, we’ve embraced this innovation to develop secure, high-speed, AI-powered biometric systems designed for government ID programs, eKYC, and palm-based payment infrastructure.

💡 Why BioWavePass?

Co-developed with China’s leading Palm Payment platform, BioWavePass devices are optimized for:

- 🔐 High-security, high-volume matching

- ⚡ Real-time identity verification

- 🧼 Contactless hygiene — perfect for post-COVID environments

Whether you’re building a banking platform, an access control system, or a public sector welfare distribution app, our palm vein devices are designed to match in less than 0,35 segundos — with 99%+ accuracy even across millions of IDs.

🔬 How Does It Work?

- Scan – The user waves their palm over the scanner.

- Capture – RGB + IR sensors capture both color and infrared patterns.

- Extract – AI algorithms extract feature points from the palm vein map.

- Match – These features are matched against a secure local or cloud database.

- Authenticate – If a match is found, access is granted or a payment is approved.

Each palm scan creates a biometric signature that’s near impossible to replicate, and because it’s non-contact, it’s also inherently more hygienic and tamper-proof than fingerprint or face scans.

🆚 Why Not Fingerprints?

Unlike fingerprints, which can be damaged, faked, or worn down, palm vein biometrics are:

- ✅ Internal (not left on surfaces)

- ✅ Uniquely secure (no two vein patterns are alike)

- ✅ Stable over a lifetime

- ✅ Contactless and friction-free

This makes BioWavePass the go-to solution in healthcare, fintech, eKYC, y public infrastructure.

🌍 Real-World Impact

BioWavePass is already enabling:

- 💳 Palm-based payments in rural banking apps

- 🆔 Biometric eKYC for government subsidies

- 🏥 National ID & healthcare integration in emerging markets

Con open SDKs, MDM device control, and support for Android, Linux, y Windows, developers can deploy scalable, secure biometric solutions without reinventing the wheel.

🚀 The Future in Your Hand

We believe the future of digital identity and authentication is invisible, seamless, and secure — and it starts in the palm of your hand.

Con BioWavePass, we’re not just building hardware — we’re co-creating a world where your palm becomes your passport, your payment method, and your identity key.

Comparte este artículo

Sobre el autor

También le puede interesar

Which Is the Best Mobile Palm Pay Device?

What is Palm Vein E Wallet Technology?

¿Qué es un sistema de pago por vena de la palma de la mano? BioWavePass Palm Vein Payment Tipos de clientes y visión general de la arquitectura

¿Cómo construir un sistema de pago Palm Vein sin un pesado trabajo de certificación local?

¿Cuál es el mejor terminal de pago móvil Palm Vein?

¿Por qué la biometría venosa de la palma de la mano ofrece la fiabilidad que las plataformas fintech necesitan para las transacciones de alta frecuencia?

¿Cómo simplifica BioWavePass la integración de Palm Vein para las plataformas fintech que crean ecosistemas de identidad y pagos?

Cómo BioWavePass mejora la seguridad de los pagos con la autenticación de la vena de la palma de la mano basada en la nube?

Por qué la tecnología de modo dual RGB más IR es esencial para la autenticación financiera y eKYC a gran escala?