How Does Palm Pay Work—and What Happens When You Pay With Your Hands?

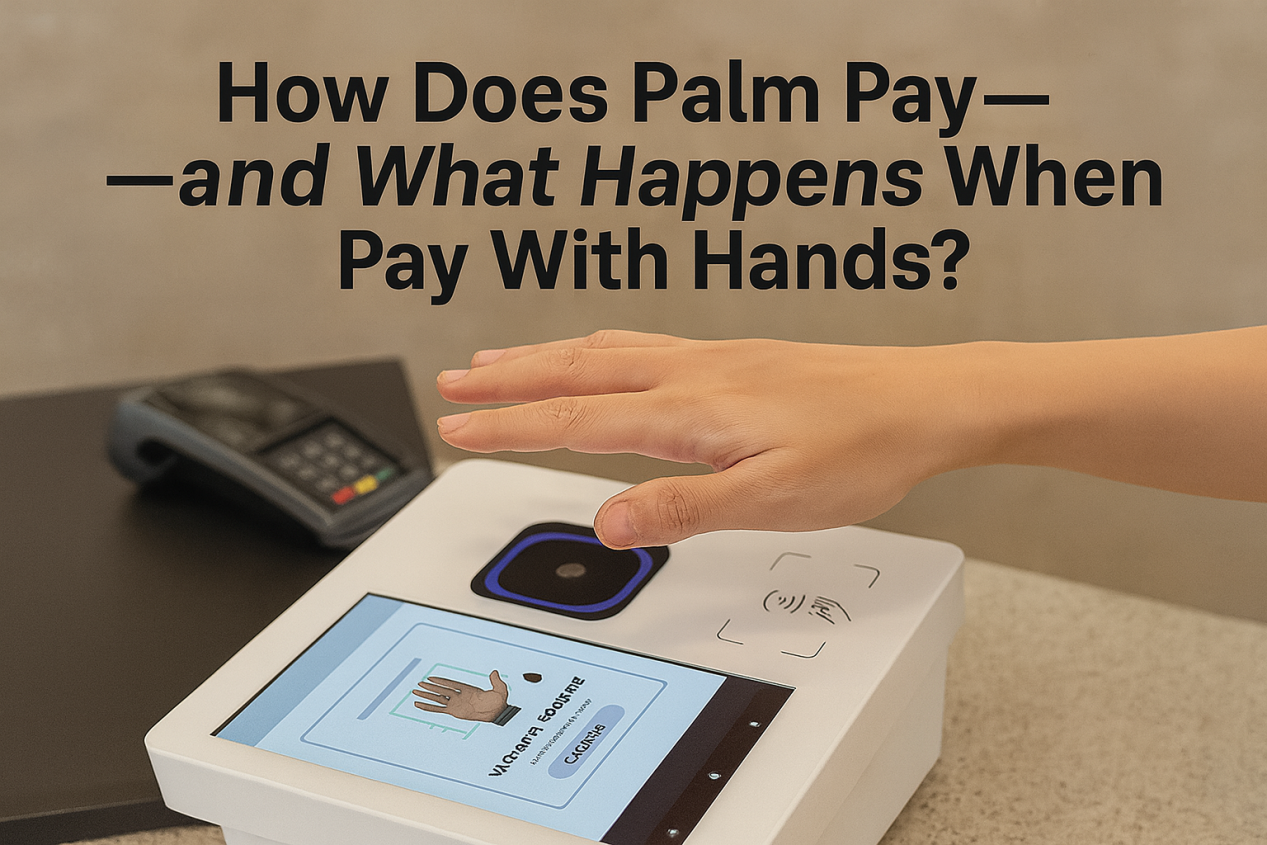

Biometric payment has entered a new era. With Palm Pay, users no longer need to carry cards, phones, or IDs—your palm becomes your secure identity. At BioWavePass, we’ve designed a hardware-agnostic platform to make Palm Pay truly scalable, privacy-compliant, and real-time ready.

So how exactly does Palm Pay work? What happens behind the scenes from a raised palm to a completed transaction?

This blog explains the core architecture of Palm Pay—optimized by BioWavePass technology and tested in real-world deployments across banks, government, and fintech.

Step 1: Biometric Registration Without Boundaries

Every Palm Pay journey starts with identity enrollment—binding the user’s palm to their digital profile. With BioWavePass devices, registration is fast, hygienic, and secured by AI-enhanced imaging.

Key Process:

Palm + ID Binding

Link national ID, phone number, or user account to a new Palm ID.RGB + IR Dual-Mode Capture

We collect both surface palmprint and subcutaneous vein patterns.Feature String Extraction

Our dual-modality AI engine generates four biometric markers:- RGB image

- IR image

- RGB feature string

- IR feature string

Secure Binding & Sync

These are locally or remotely encrypted and stored under a unique biometric index.

Our devices require users to remove gloves to ensure clean IR & RGB imaging.

Step 2: Real-Time Matching at the Terminal

At checkout, subsidy points, or access control, users simply raise their hand.

Our terminal (e.g., BioWavePass500) instantly:

- Detects palm presence

- Captures new RGB + IR image streams

- Extracts fresh feature strings

- Matches against the database (cloud or local)

Only if all four factors match will Palm ID verification pass.

Algorithm Performance:

| Metric | Result |

|---|---|

| Matching Speed | 0.315 seconds (5M database) |

| Accuracy (FRR@FAR) | RGB: 0.002% / IR: 1.52% |

| Combined Risk | < 1 in 100 billion |

If either RGB or IR fails, the match will be denied. This ensures dual-liveness detection and zero tolerance for forgery.

Step 3: Payment Token Issuance

Once matched, the system generates a one-time payment token. This token acts as the user’s approval for the backend to proceed.

Token Payload Includes:

BioPalmID: Anonymous user match keyTerminal ID: Origin device identityMerchant Session: Transaction session codeNonce: Random anti-replay stringTimestamp: Token validity (e.g. 30–60s)Signature: Encrypted hash of the above

No financial data or real identity leaves the device—only the secure token is transmitted.

Step 4: Payment Authorization

The token is sent to the connected payment platform, which may be:

- A bank payment gateway

- A government digital subsidy portal

- A private fintech cloud wallet

The backend verifies the token, checks permissions, and completes the transaction.

The result (success/failure) is then returned to the terminal in real time.

Palm Pay enables completely hands-free, cardless, password-free authentication while maintaining security.

BioWavePass Advantages

| Feature | Value Proposition |

|---|---|

| RGB + IR Dual Imaging | True biometric liveness detection |

| 4-Factor Matching | Enhanced security with AI feature fusion |

| Large-Scale Matching Engine | Tested on 5M+ private ID databases |

| Cloud & Edge Compatible | Works with remote or local matching servers |

| Token-Based Security | Compliant with PCI-DSS and data privacy standards |

| Flexible SDK Integration | Support for Android, Windows, Linux environments |

| No Vendor Lock-In | Open API structure, compatible with any platform |

Real-World Scenarios

- National subsidy collection — bind palm + ID once, then redeem without carrying documents

- Smart retail checkout — reduce checkout time and eliminate physical contact

- eKYC onboarding — biometric registration for banks and e-wallets

- Healthcare access — verify patients without cards or typing

- Borderless travel — secure biometric boarding without passports

BioWavePass: Own Your ID. Wave Your Palm.

BioWavePass isn’t just a hardware provider—it’s a platform partner for governments, banks, fintechs, and integrators looking to build secure, compliant, real-time biometric ecosystems.

We offer:

- Embedded palm vein devices

- Fully documented SDKs

- On-device encryption

- Token-based middleware

- Custom licensing (10K IDs free, large DBs supported)

- End-End Solutions

Learn more at: [www.biowavepass.com]

Share this article

About the Author

You might also like

Which Is the Best EMV & PCI Certified Palm Vein POS Terminal?

Will Palm Vein POS Support Existing EMV, NFC, and QR Payment Ecosystem?

Why Palm Vein Technology Is Emerging as a Payment-Grade Biometric Standard

Where Is Palm Vein Biometric Data Stored and How Is It Secured?

How Do You Choose the Best Palm Vein Technology for Real Projects?

How to Solve Power Issues in Palm Vein Scanner Projects?

What Is Palm Scanning Technology?

How Palm Vein Biometrics Can Be Integrated Into Mobile Payment Systems: A BioWavePass Implementation Guide

How to setup Palm Payment? Designing a Seamless Palm Payment Flow for Fintech and Payment Platforms