Introducción

Digital wallets are pushing authentication into a new era where identity must be foolproof and transactions must be instant. Traditional PINs, passwords, or face/fingerprint unlock offer convenience, but they carry a critical weakness: they are external, visible, or easily captured, making them targets for spoofing, credential theft, and database fraud.

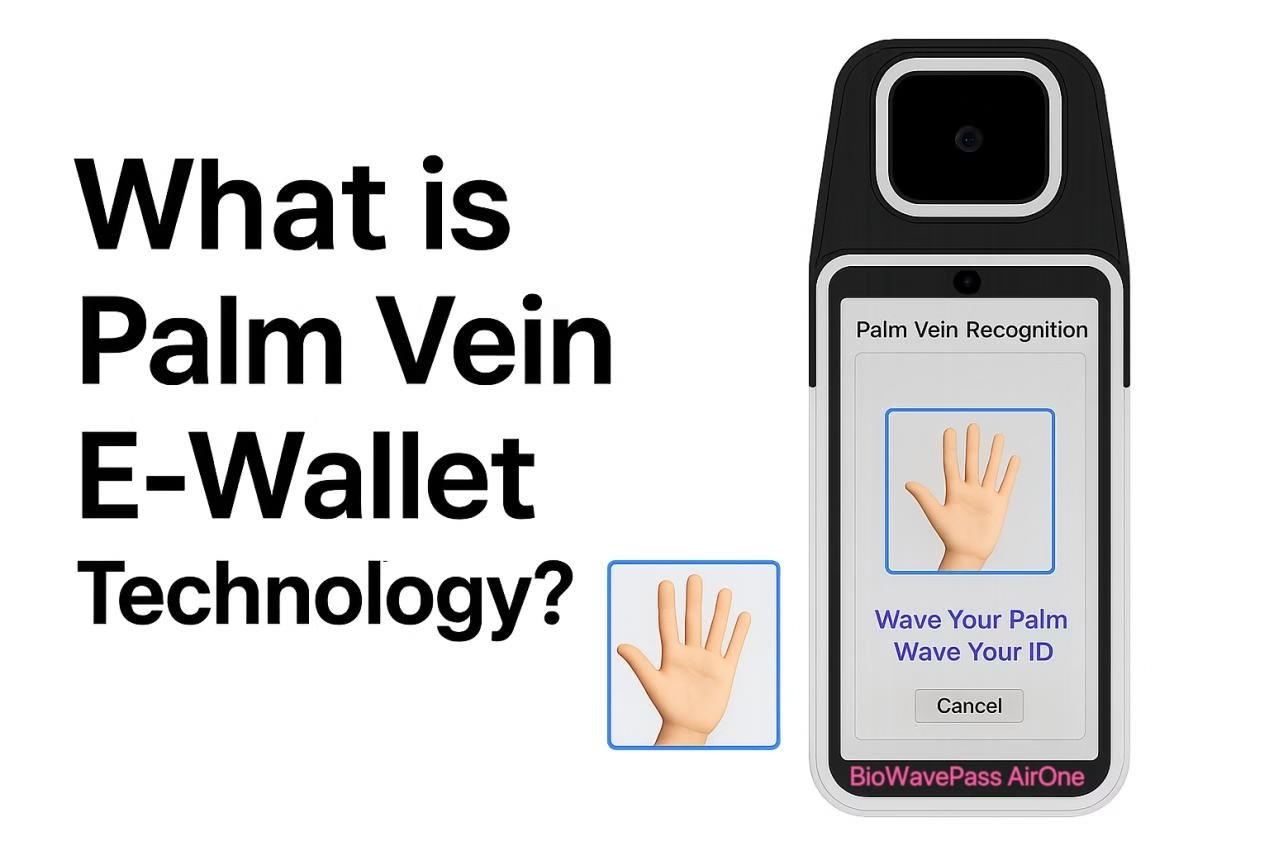

Palm Vein E-Wallet Technology changes this paradigm by using internal vein structures as identity proof and tying that identity directly to payment authorization. BioWavePass built its biometric wallet solution on the principle that Your Palm Is Your Wallet, enabling fintech platforms to process identity and payment in a single secure pipeline.

1. How Palm Vein Wallet Authentication Works

A palm vein e-wallet uses a two-step verification process powered by dual-spectrum imaging:

- Palm image is captured via RGB (visible light) + IR (near infrared) simultaneously.

- The system extracts the unique subdermal vein map, hand geometry and surface structure.

- A biometric identity template is encrypted and submitted to the fintech cloud API.

- Payment authorization is granted only if identity verification succeeds.

Because the data source is beneath the skin, vein patterns do not change based on aging, environment, or user interaction patterns. This gives palm biometrics a fundamentally higher reliability rating than external biometric forms.

2. Why Fintech Wallets Need Palm Vein Biometrics

A biometric e-wallet must serve two masters: security and scale. Leading fintech platforms share similar requirements when adopting palm vein authentication.

Fraud-resistant identity layer

Internal vein characteristics cannot be copied through photos or lifted from physical surfaces.

Cloud native identity orchestration

The device trusts the fintech’s Identity API y Payments API, instead of storing identities in localized terminals.

Matching time is approximately 0.35 seconds, keeping authentication and payments user-seamless.

Open SDK for development teams

No firmware dependency and full SDK support for Android, Windows, and Linux enable rapid wallet development.

Real mobility support

For mobile banking agents, payment staff, or large identity registration programs, handheld POS design and battery usage are essential.

These insights represent a category of customers, not one single case.

3. Introducing BioWavePass AirOne for Palm Vein Wallet Payments

Generic biometric modules fall short for financial wallets because they lack card scheme security certification. This is why BioWavePass and BioWavePass co-engineered AirOne not as a small biometric module, but as a true Banking-POS-grade biometric wallet terminal.

The AirOne design philosophy was to embed the PalmVein01 USB RGB plus IR palm scanner into an EMV L1/L2 and PCI-validated POS architecture at the manufacturing level.

This ensures:

✔ payment structure is already EMV + PCI certification-ready

✔ biometric module is protected by POS-grade firmware routing

✔ no need for local re-certification

✔ no motherboard redesign by clients

✔ no added firmware or lab complexity

✔ integration risk is removed

The device ships as a palm scanning POS terminal born secure, not retrofitted.

4. Key Technical Differentiators of a Palm Vein Wallet Terminal

To support real fintech wallet scale, a device must meet technical and commercial grade expectations:

Dual mode biometric capture

RGB plus IR imaging provides clear vein depth and surface stability.

Extreme authentication precision

FAR/FRR rate achieves 1 in 100 billion, minimizing error even in massive ID sets.

Mass commercial performance validation

BioWavePass palm biometrics have been commercially proven for 3+ years, supporting 300M+ users with 99% accuracy.

Cloud secured identity communication

Devices collect biometrics locally, cloud verifies via WiFi or USB plus WiFi without RS232 or OTG converters.

Power consistency for stability

1.5A / 5V minimum power is required for stable RGB plus IR scanning. Compatibility is checked early.

5. Typical Palm Vein Wallet Rollout Model

Most fintech teams follow a predictable deployment logic when adopting palm biometrics.

Phase 1: Pilot (10 units or less)

- Palm vein terminal connects to Android billing device via USB or WiFi.

- No POS host redesign.

- Biometric identity verified by cloud API.

- Data transmitted securely.

- Developer SDK integrated inside current app.

Phase 2: Mass Merchant Expansion

If identity and payment pairing performs smoothly, fintechs scale into:

- Retail checkout networks

- High-frequency billing applications

- Loyalty or membership apps

- Mobile banking agents

- eKYC and subsidy systems

This growth path can scale into hundreds or thousands of devices per year on mature APIs.

6. Industry Use Cases for Palm Vein Wallet Authentication

Palm vein wallets are practical for any offline identity plus payment scenario.

Common use cases include:

- Fintech e-wallet identity unlock

- QR billing plus biometric authorization

- Membership database and loyalty wallet sign-in

- Agent walk-around mobile POS payments

- Kiosk payments that require strong identity certainty

- Fraud-controlled billing terminals

- Systems transitioning away from static passcodes

Wherever offline identity is a payment dependency, palm veins provide the most reliable assurance.

Conclusión

So, What is Palm Vein E Wallet Technology?

It is a cloud authorized identity system powered by internal vascular structure, secured by RGB plus IR dual spectrum capture, validated at billion-scale precision, and paired directly with mobile payment authorization inside a unified fintech API chain.

BioWavePass, powered by BioWavePass hardware architecture, delivers this vision through AirOne, a banking-POS-grade mobile palm vein terminal that is manufactured certification-ready, cloud API aligned, developer-accessible, and deployable in weeks instead of months.

Palm vein biometrics are not the future.

They are the present foundation fintech wallets trust for identity and payment certainty at scale.

Explore palm vein solutions at: https://biowavepass.com/mobile-palm-vein-pos-terminal/

Comparte este artículo

Sobre el autor

También le puede interesar

Which Is the Best EMV & PCI Certified Palm Vein POS Terminal?

Will Palm Vein POS Support Existing EMV, NFC, and QR Payment Ecosystem?

Why Palm Vein Technology Is Emerging as a Payment-Grade Biometric Standard

Where Is Palm Vein Biometric Data Stored and How Is It Secured?

How Do You Choose the Best Palm Vein Technology for Real Projects?

How to Solve Power Issues in Palm Vein Scanner Projects?

What Is Palm Scanning Technology?

How Palm Vein Biometrics Can Be Integrated Into Mobile Payment Systems: A BioWavePass Implementation Guide

How to setup Palm Payment? Designing a Seamless Palm Payment Flow for Fintech and Payment Platforms